Payroll or paycheck is the most important factor that links an employee to an organization. Employees always expect to get paid accurately in time which is one of their primary rights of being employed and when they miss out on such an important aspect of employment with delayed and inaccurate payment they get frustrated which often motivates them to change their job too. No matter how great the other aspects of the organization are, an employee will always prefer better payroll over anything else.

Additionally, according to The Workforce Institute, 49% of employees will start looking for a new job after experiencing only 2 problems with their paycheck.

Accurate and on time payment is one of the core pillars behind building a successful organization performing with greater excellency. Even if you put your strategies right the inefficiency with payroll will leave the workers dissatisfied, demoralized and looking to quit for better options which will hamper progress of the organization for years to come. So if mismanaged payroll can backfire so much why are organizations still failing to pay their employees on time or manage a functional payroll system? Let’s take the conversation forward as we also imply the solutions to overcome payroll mistakes.

Contents

- 1 Top 10 Common Payroll Mistakes Globally

- 1.1 Missing Deadlines:

- 1.2 Misclassifying Workers:

- 1.3 Negligence in Complying with Law:

- 1.4 Poor Record Keeping & Data Entry:

- 1.5 Delaying Payroll Updates:

- 1.6 Miscalculating Overtime/Bonus/Taxes:

- 1.7 Unautomated Systems:

- 1.8 Not Saving Payroll Records:

- 1.9 Not Maintaining Confidentiality:

- 1.10 Not Having Adequate Backup:

- 2 How Payroll Mistakes Can Affect Your Business

- 3 How to Avoid Payroll Errors

- 3.1 1) Maintain Accurate Employee Records

- 3.2 2) Comply with Laws And Regulations

- 3.3 3) Implement a Reliable Payroll System

- 3.4 4) Double-Check Data Entry

- 3.5 5) Conduct Regular Audits

- 3.6 6) Train Payroll Staff

- 3.7 7) Maintain Backups & Secure Data

- 3.8 8) Reconcile Payroll Reports

- 3.9 9) Take Expert Assistance

- 3.10 10) Stay Updated

- 4 How Enroute Can Help You Streamline Your Payroll

- 5 Conclusion

- 6 Frequently Asked Questions for Payroll Mistakes

Top 10 Common Payroll Mistakes Globally

In the ever-evolving world of payroll management, organizations around the globe face numerous challenges in ensuring accurate and compliant payroll processes. From small businesses to multinational corporations, errors in payroll can have significant consequences for both employers and employees. In this article, we will delve into the top 10 most common payroll mistakes that occur globally, shedding light on these critical issues and providing insights on how to avoid them.

As businesses strive to maintain efficiency and accuracy in their payroll operations, it is crucial to identify potential pitfalls that may lead to costly errors. By understanding these common mistakes, organizations can take proactive measures to prevent them from occurring and safeguard their financial stability while upholding employee satisfaction.

Missing Deadlines:

Missing deadlines is the most common payroll mistake globally. Failing to meet the deadlines on filing taxes can incur a penalty. Often organizations fail to miss deadlines due to their backdated process as well. Which results in employee dissatisfaction & legal issues as well.

Misclassifying Workers:

With the growth of the organization comes the need of classifying workers. As the number of contractual, independent consultants, short term employees, project based teams increases the need of classifying them increases as well. Misclassification can result in payroll and tax errors.

Negligence in Complying with Law:

Taxes & laws are subject to change anytime depending on the national laws. Organizations operation in multiple counties as well as local companies often overlook the compliance & laws regarding the payroll which results in inaccurate payroll & taxes.

Poor Record Keeping & Data Entry:

Record & data are key necessity behind processing accurate & on time payroll management and should be finalized in pre employment verification. Often a lack of sync in the working process between employee, employer & data team results in poor or backdated record keeping. Which results in wrong process of payroll failing on time payment.

Delaying Payroll Updates:

Delayed payroll updates can be a result of many factors such as incomplete information, complex structure, changing compliance, technical issues & late submissions if a system does not look over all these factors and update over the time it can cause payroll delay.

Miscalculating Overtime/Bonus/Taxes:

Appraisals, bonuses, incentives & many other variables change over the time. But when a small team or individual works in processing the payroll it can often get miscalculated which again hampers employee expectations of getting paid in time & accurately which can cause payroll error.

Unautomated Systems:

Still in many organizations process the payroll without software and involves pen & paper. These unautomated systems cause a big chunk of time to process the payment while paying different employees under different preference. This is a common problem in many organizations who does not invest in technology & improvements.

Not Saving Payroll Records:

Every processed payroll record should be kept for different documentation in times to come. But often lack of record connected with compliance and taxes results in payroll delays.

Not Maintaining Confidentiality:

Confidentiality is a crucial part of payroll as this is a sensitive data and should not go outside payroll team and senior management. Lack of confidentiality or mistakenly disclosed data can hamper an organization badly.

Not Having Adequate Backup:

Payroll is never a one man do all job. Adequate backup is necessary for sick days or big data processing which is a demanding task. Adequate backup is always needed in disposal when required can be the reason of significant delay and mismatched payroll for any organization.

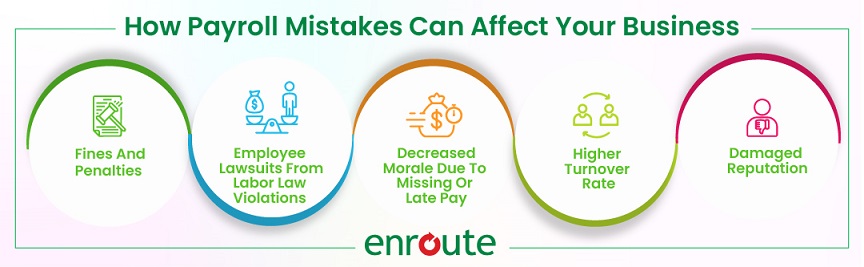

How Payroll Mistakes Can Affect Your Business

How Payroll Mistakes Can Affect Your Business

Payroll mistakes are not only threatening for an organization to live up to its strategy in the long run, it also can have significant affects on many other aspects as well. Some of them are,

- Fines And Penalties:

Mistaken payroll can be costly as government fines and penalties are the most common threat of payroll mistakes. Organizations should be always careful of compliance and laws to avoid fines and penalties.

- Employee Lawsuits From Labor Law Violations:

Not paying employees in time due to data or record problems can cause lawsuits from employees and can also be a reason of labor law violation in many countries and can be costly.

- Decreased Morale Due To Missing Or Late Pay:

When employees get late payment time after time it decreases their morale of working extensively for the organizations and majority employees won’t be performing efficiently.

- Higher Turnover Rate:

Delayed and inaccurate payment results with a higher turnover rate resulting an organization to look for employees too often. Higher turnover rate is directly related to low salary or delayed paychecks.

- Damaged Reputation:

Most of the employees being the victim to payroll issues are more likely to not recommend your organization to any potential employees in the coming future. Also while they will move on to their next organization are more likely to not recommend the organization either which shall have significant damage in reputation as well as employer branding.

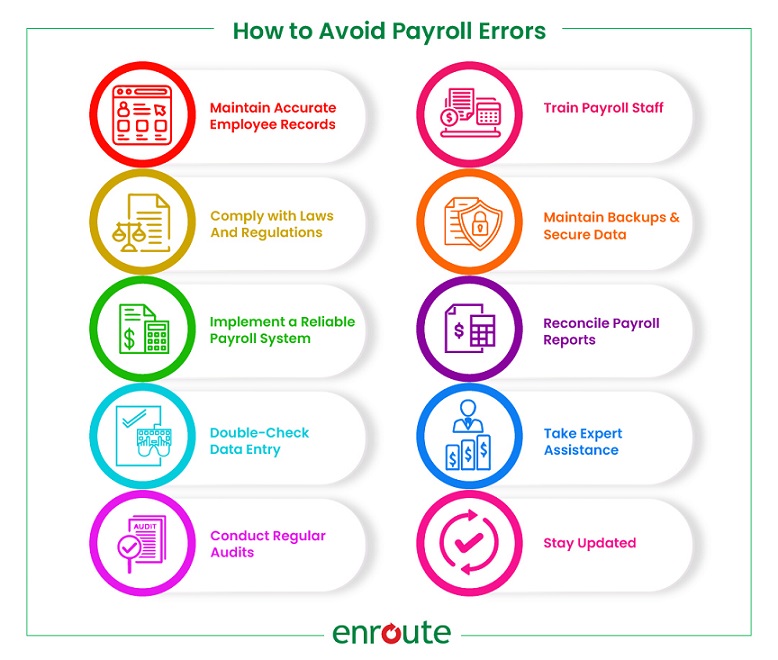

How to Avoid Payroll Errors

Till now we have discussed extensively about corporate payroll, its issues and results caused by the problems. Let’s have a look at some of the top tips from our expertise of providing paysolutions for 15 years.

1) Maintain Accurate Employee Records

Maintaining accurate employee records are the primary task behind maintaining your well oiled payroll machine. Some of the things you can follow to keep accurate employee records are:

- Establish a systematic record-keeping process.

- Regularly update employee information.

- Maintain confidentiality and data security.

- Conduct periodic audits and quality checks.

- Train employees on record-keeping procedures and policies.

2) Comply with Laws And Regulations

Complying with laws & regulations are crucial if you want to continue your business sustainably in any country. Here are top 5 best practices to comply with tax laws & compliance regulations.

- Stay updated on relevant laws and regulations.

- Develop and implement policies and procedures.

- Conduct regular internal audits and assessments.

- Provide comprehensive employee training on compliance.

- Maintain accurate and organized documentation.

3) Implement a Reliable Payroll System

Payroll with QuickBooks is a popular option if you want a reliable system and does not want to invest significant amounts of resources but without a reliable payroll system you won’t be able to continue your payroll operation from month to month and continue without hamper in the operation. Here is how you can implement a reliable payroll system

- Evaluate and choose a suitable payroll software solution.

- Define clear payroll processes and procedures.

- Ensure accurate employee data management.

- Establish robust backup and data security measures.

- Conduct thorough testing and training before going live.

4) Double-Check Data Entry

Data are the most significant part of processing payroll for any organization. Lack of attention in data entry & record keeping can be the problem behind misleading data. Always double check the data & keep these tips in mind,

- Human error during manual input.

- Missed or incorrect data validation checks.

- Lack of standardized data entry guidelines.

- Insufficient training on data entry procedures.

- Inadequate data quality control measures.

- Incomplete or inaccurate source documents.

- Data entry from illegible or poorly organized documents.

- Inconsistent formatting or data structure.

- Data entry shortcuts leading to mistakes.

- Lack of proper review and verification processes.

5) Conduct Regular Audits

Regular audits are important to keep your payroll in place. Here is why regular audits are important,

- Identify errors and discrepancies.

- Ensure compliance with regulations.

- Detect fraudulent activities.

- Validate accuracy of payroll calculations.

- Review and update internal controls.

- Enhance data security and confidentiality.

- Prevent unauthorized access or manipulation of data.

- Verify proper documentation and record-keeping.

- Mitigate financial and reputational risks.

- Maintain trust and transparency with employees.

6) Train Payroll Staff

Training your payroll staff is important to upgrade their capacity and ability to maintain efficient operation. Here are the most relevant trainings you can pursue,

- Payroll Processing and Calculation.

- Tax Compliance and Reporting.

- Payroll Software Training.

- Data Security and Confidentiality.

- Employment Laws and Regulations.

7) Maintain Backups & Secure Data

Maintaining proper backups as well as securing data from all kinds of data breach is important for your payroll management. Here are some of the data you should keep backup of,

- Regular full backups of all payroll data.

- Incremental or differential backups for capturing changes since the last backup.

- Offsite or cloud backups for data redundancy and disaster recovery.

- Secure backup storage to protect sensitive payroll information.

- Regular testing of backup systems to ensure data integrity and accessibility.

8) Reconcile Payroll Reports

Reconciling payroll reports come with its own set of benefits which includes risk reduction of fraud, improving employee morale and saving time & money. Here are some 7 reasons why its important

- Ensure accuracy of employee wages, deductions, and tax withholdings.

- Identify and correct discrepancies or inconsistencies in payroll records.

- Maintain compliance with labor laws, tax regulations, and other applicable regulations.

- Promote financial integrity and accurate financial reporting.

- Detect and prevent fraudulent activities and unauthorized changes to employee data.

- Maintain data integrity by ensuring complete, accurate, and up-to-date payroll records.

- Build employee trust and satisfaction through reliable and consistent payroll processes.

9) Take Expert Assistance

Often there are issues in payroll where you will require expert assistance. Taking expert advice also comes with many benefits other than consultancy. Some of them are,

- Knowledge and expertise in payroll laws and best practices.

- Time and resource savings through outsourcing payroll tasks.

- Ensuring compliance with regulations and avoiding penalties.

- Reducing errors and discrepancies in payroll processing.

- Utilizing advanced technology and automation for efficiency.

- Maintaining confidentiality and data security.

- Providing problem resolution and support for complex payroll issues.

10) Stay Updated

Staying updated with the latest payroll trends and knowledge is important for your employees to develop. Here are the things you can suggest your employees to follow,

- Follow Industry Publications

- Attend Webinars and Conferences

- Join Professional Associations

- Engage in Online Communities

- Networking with Peers

- Collaborate with Payroll Service Providers

- Continuous Learning and Professional Development

How Enroute Can Help You Streamline Your Payroll

Taxation is year long process and can not be processed overnight. & as a business owner if you are searching ‘’payroll providers near me’’ to sort out your payroll in Bangladesh we have the perfect solution. Enroute is the leading corporate payroll provider in Bangladesh working in the industry of FMCG, Telco, MNCs, INGO etc. Where we can deliver value in our service is accurate calculations, timely processing, and compliance with legal requirements for your Payroll in Bangladesh as part of our HR consulting services. Additionally we ensure,

- Fastest Processing

- Self Service Software

- Certified Payroll Professionals

- Simple Business Integration

For over 15 years we have driven business value for the clients & ensure results to its highest standards. Collaborate with us to simplify your payroll in bd.

Conclusion

Payroll is a complex yet necessary element for any organization to thrive. While mistaken payroll can damage an organization in many ways well maintained payroll can also benefit in numerous ways. While expanding business or requiring support to sort our your payroll for years to come take expert consultancy from the experts & take your business to a sustainable height.

Frequently Asked Questions for Payroll Mistakes

- What are the consequences of misclassifying employees?

Answer: Misclassifying employees can lead to various consequences, including tax penalties, legal liabilities, and potential lawsuits. It is crucial to accurately classify employees to ensure compliance with labor laws and tax regulations.

- How can I avoid payroll tax penalties?

Answer: To avoid payroll tax penalties, stay updated with the latest tax laws and regulations, accurately calculate and withhold payroll taxes, and ensure timely tax filings. Utilizing payroll software with built-in tax compliance features can also help minimize errors and ensure compliance.

- What records should I maintain for payroll management?

Answer: For effective payroll management, maintain records such as employee information, tax forms, timesheets, wage rates, benefits deductions, and payroll registers. Keeping these records organized and up-to-date is essential for accurate payroll calculations and compliance.

- How can I prevent errors in calculating employee wages?

Answer: To prevent errors in wage calculations, utilize reliable payroll software that automates calculations based on wage rates, hours worked, and any applicable overtime or deductions. Regularly review and verify payroll data to catch any discrepancies or errors before processing payments.

- What are the risks of manual payroll processing?

Answer: Manual payroll processing poses risks such as data entry errors, miscalculations, and delays. It also consumes significant time and resources. Implementing automated payroll systems reduces these risks, improves accuracy, and streamlines the payroll process.

- What is the tax return rate in Bangladesh?

Answer: Every employee has to file annual tax returns. The income tax rates are as follows:

| Tax Rate | Annual Income Level in BDT |

| 0% | Up to Tk. 300,000 |

| 5% | Next Tk. 100,000 |

| 10% | Next Tk. 300,000 |

| 15% | Next Tk. 400,000 |

| 20% | Next Tk. 500,000 |

- What are the payroll options for companies in Bangladesh?

There are four main options for payroll procedures in Bangladesh. Those are,

- Remote

- Internal

- Payroll Processing Company

- Outsourcing Payroll

- How can I enhance data security in payroll management?

To enhance data security, restrict access to payroll systems and sensitive employee information to authorized personnel only. Implement strong password policies, regularly update software and systems, and consider encryption and secure backup solutions to protect payroll data from unauthorized access or loss.

- What should I do to ensure compliance with overtime regulations?

To ensure compliance with overtime regulations, accurately track and record employee hours, classify employees correctly, and calculate overtime wages according to applicable laws. Regularly review and update policies to reflect any changes in overtime regulations.

- How can I streamline the payroll process to save time?

Streamlining the payroll process involves automating tasks, utilizing payroll software, and implementing efficient workflows. Standardize payroll procedures, leverage direct deposit for payments, and automate tax filings to reduce manual efforts and save time.

- What payroll taxes do employers pay in BD?

Tax policy in BD is different than other countries and some of the taxes & contribution paid by the employees are:

- Income Tax (applicable in salary, bonus, commission, incentive & any other benefits)

- Employees’ Provident Fund (EPF) as part of contribution.

- Gratuity contribution.

- Welfare fund. (variable)

- Other contribution that varies from company to company.

- Where do payroll taxes go?

Payroll taxes go directly in governments fund which is a key source of national expenses and development works.

- How to Set Up a Payroll in Bangladesh?

To set up payroll in Bangladesh as a foreign company, you will need to follow a step-by-step process. Here is a simplified outline:

- Establish a Subsidiary: Begin by establishing a subsidiary of your company in Bangladesh. This involves registering the subsidiary with the appropriate authorities and completing the necessary legal and administrative procedures.

- Bank Account Opening: Open a bank account in Bangladesh to facilitate payroll transactions. This is important for obtaining an encashment certificate, which validates the conversion of foreign currency into Bangladeshi taka.

- Register with RJSC: Submit the encashment certificate to the Register of Joint Stock Companies and Firms (RJSC) for approval. This registration step is required to formalize your subsidiary’s presence and operations in Bangladesh.

- Obtain Business Identification Number (BIN): Apply for a Business Identification Number from the National Board of Revenue (NBR). This number is essential for tax identification and compliance purposes.

- Obtain Tax Identification Number (TIN): Establish the process for obtaining Tax Identification Numbers for your employees. This is necessary for accurate tax withholding and reporting.

- Determine Payroll Schedule: Determine the payroll schedule that aligns with your business requirements. Common options include monthly, semi-monthly, biweekly, or weekly pay periods.

- Calculate Employee Compensation: Calculate the gross pay for each employee based on their salary, allowances, and any applicable overtime or bonuses.

- Deductions and Taxes: Determine the deductions for each employee, including income tax, social security contributions, and any other mandated withholdings. Ensure compliance with the prevailing tax regulations.

- Calculate Net Salary: Subtract the deductions from the gross pay to calculate the net salary that employees will receive.

- Maintain Payroll Records: Keep accurate and comprehensive records of the entire payroll process, including employee information, salary details, tax deductions, and compliance documentation.

It’s important to note that the process of setting up payroll in Bangladesh can involve additional legal, regulatory, and administrative requirements. Engaging with local legal and accounting professionals who are well-versed in Bangladesh’s laws and regulations is advisable to ensure compliance and accuracy in the payroll setup.

Leave a Reply