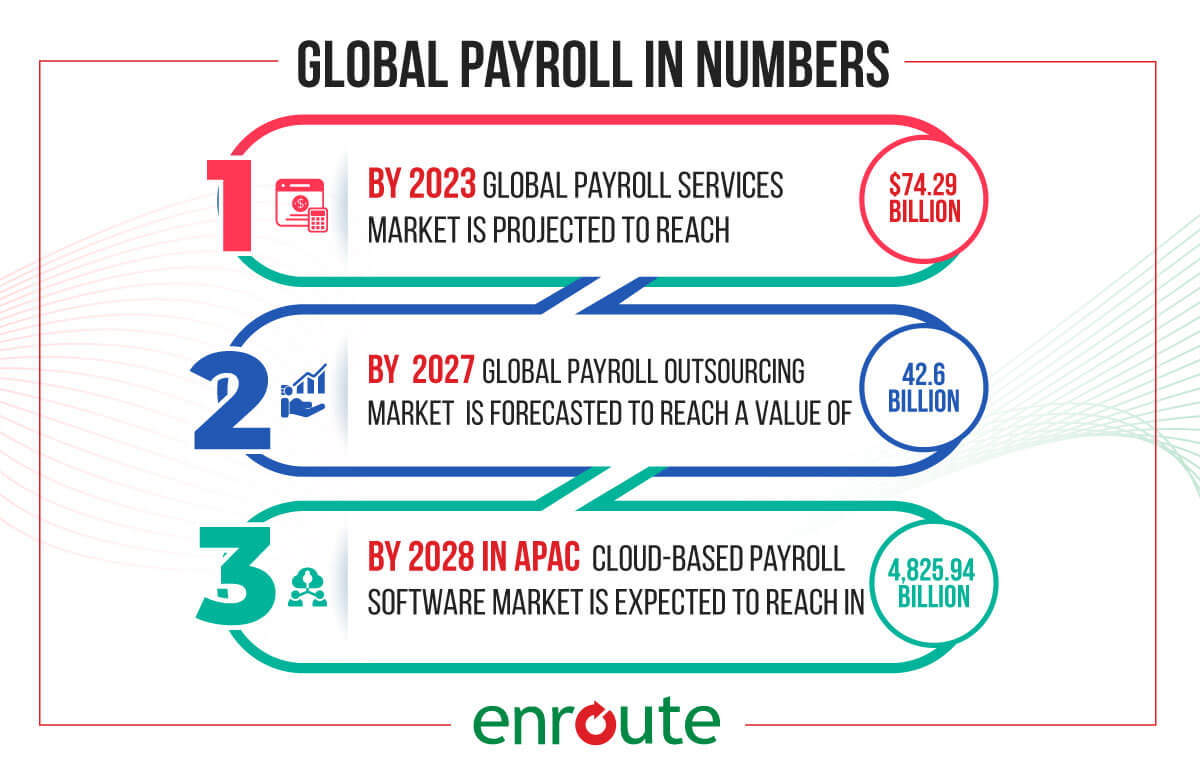

Countries across the Asia Pacific are experiencing rapid growth and emerging as major contributors to the global outsourcing landscape. Within this region, the market for cloud-based payroll software is projected to expand significantly, growing from US$ 2,236.52 million in 2022 to US$ 4,825.94 million by 2028 (source). This growth represents an estimated compound annual growth rate (CAGR) of 13.7% between 2022 and 2028.

Bangladesh, a renowned powerhouse in the Ready-Made Garment (RMG) sector, is also demonstrating considerable progress toward achieving a billion-dollar economy. This robust economic development is positioning Bangladesh as a leading outsourcing provider for countries like the United States, United Kingdom, Canada, and various European nations.

So, if you are looking for an outsourced payroll provider compatible with your organization why would you overlook Bangladesh? To strengthen our argument further, let’s look into the top 7 benefits of payroll outsourcing in Bangladesh.

Contents [hide]

- 1 What are the 7 Benefits of Payroll Outsourcing?

- 2

- 2.1 1. Cost reduction in the payroll process

- 2.2 2. Payroll expertise in compliance and regulation

- 2.3 3. Enhanced focus on core business functions

- 2.4 4. Access to advanced payroll service technology

- 2.5 5. Scalability and flexibility of outsourced payroll solution

- 2.6 6. Enhanced security of payroll providers

- 2.7 7. Reduced error rates and improved payroll management

- 3 How to identify an outsourcing payroll services provider?

- 4 Conclusion

- 5 Frequently Asked Question for Benefits of Payroll Outsourcing

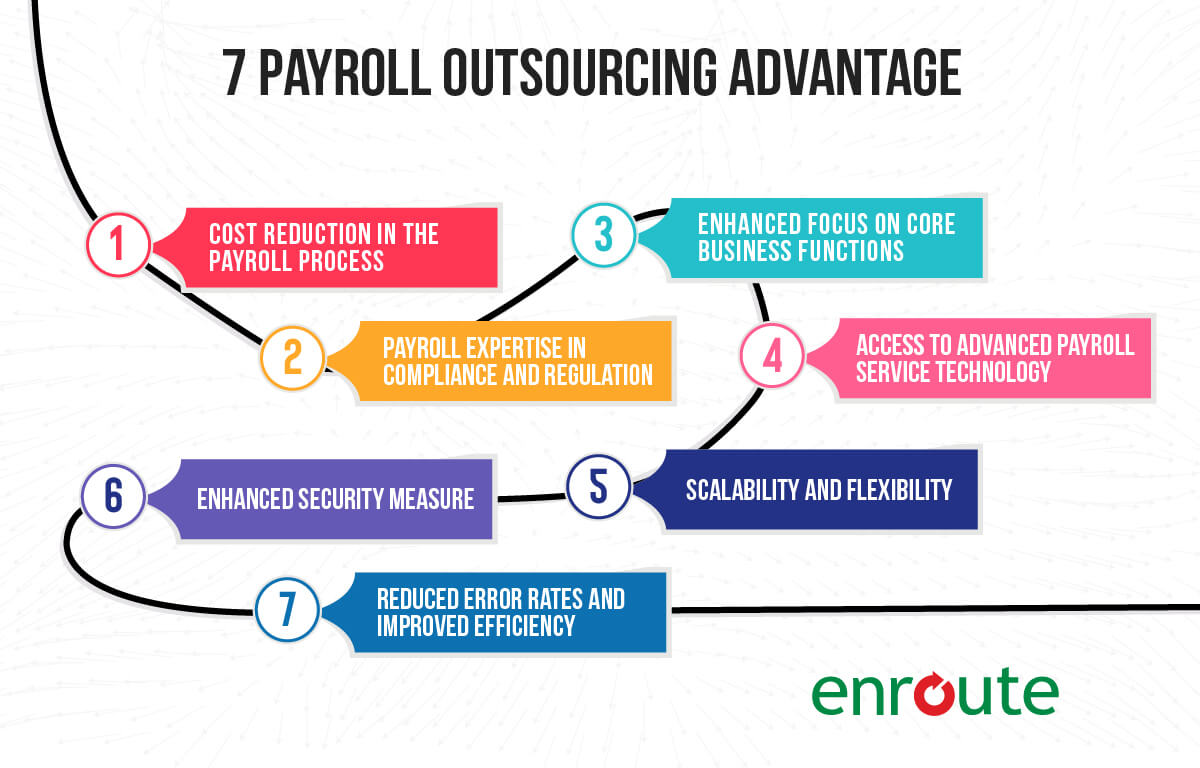

What are the 7 Benefits of Payroll Outsourcing?

As a business owner making strategic business decisions needs to be based on precise data and facts. When you are looking to outsource your payroll function it is one of the toughest ones. So here we will be describing the top 7 business benefits that will not only make your decision easier but also provide you with a proper idea of where the areas you will benefit from are. So here is the list of why you should consider outsourcing your payroll.

1. Cost reduction in the payroll process

Cost reduction should be one of the primary reasons behind outsourcing your payroll management to an outsourcing service provider. Bangladesh has one of the lowest average labor and operational costs. An individual working in the US market earns about $7k+ in monthly salary (Zippia report), and an average payroll service provider in Bangladesh earns around $3k monthly.

Which shows an exceptionally lower expense for the service without compromising the quality. This makes payroll outsourcing services in Bangladesh exceptionally valuable to companies around the world.

2. Payroll expertise in compliance and regulation

Proper expertise is crucial in ensuring compliance with both foreign and local regulatory requirements like payroll tax for safeguarding your company against potential legal and financial penalties.

Bangladesh has a rising number of exceptional payroll solution providers that accommodate talented payroll professionals who have the knowledge and understanding of how compliance and regulations work. So you can outsource the payroll responsibilities without having a second thought.

3. Enhanced focus on core business functions

When your in-house payroll department will be able to run payroll by delegating the task to a payroll outsourcing provider they will be able to focus on your core business functions even more.

Even if you are a small business owner you can delegate your HR and payroll and focus on growing your business to the next level. When you outsource to the right payroll team you will be able to focus on driving innovation, improve customer service, and enhance competitive edge in the market.

4. Access to advanced payroll service technology

One of the reasons behind outsourcing payroll is the advanced payroll system. Advanced systems offer efficiency, accuracy, and security in payroll processing, which can be a significant upgrade over traditional in-house methods.

A large number of payroll companies in Bangladesh use advanced technology to manage payroll in a better way. Which will provide you with proper payroll data for your needs. These also give you an option of easy integration with your business and avoiding payroll errors.

5. Scalability and flexibility of outsourced payroll solution

It’s great to have a payroll in-house but often this becomes a luxury for small business owners. So when you are on the startup level you need to spend your resources carefully and let others handle payroll for you.

One of the biggest advantages of working with a professional payroll company is that, as you grow ahead and expand your company the payroll and HR functions can be scaled with your business as well. When you will outsource your payroll operations to Bangladesh you will find the scalability and flexibility of your one of the biggest strengths.

6. Enhanced security of payroll providers

Payroll information is highly confidential and should be within the company’s grab. Payroll needs proper security for this reason. Bangladeshi payroll providers use the top cybersecurity measures to streamline payroll for their clients.

Many payroll providers in Bangladesh also have their own cyber security team to deliver their payroll tasks securely year after year. That is why payroll outsourcing companies in Bangladesh have a distinct reputation in the international outsourced marketplace.

7. Reduced error rates and improved payroll management

When you have a team of payroll specialists at your disposal the chances of payroll mistakes become significantly lower. This accuracy is not only critical for compliance but also plays a vital role in maintaining employee trust and satisfaction.

There are many reputable payroll providers in Bangladesh that provide quality payroll services within the payroll laws so you can be fully relaxed while outsourcing your organization’s payroll. If you want to learn more about how to cut out your payroll mistakes here is a guide for you.

How to identify an outsourcing payroll services provider?

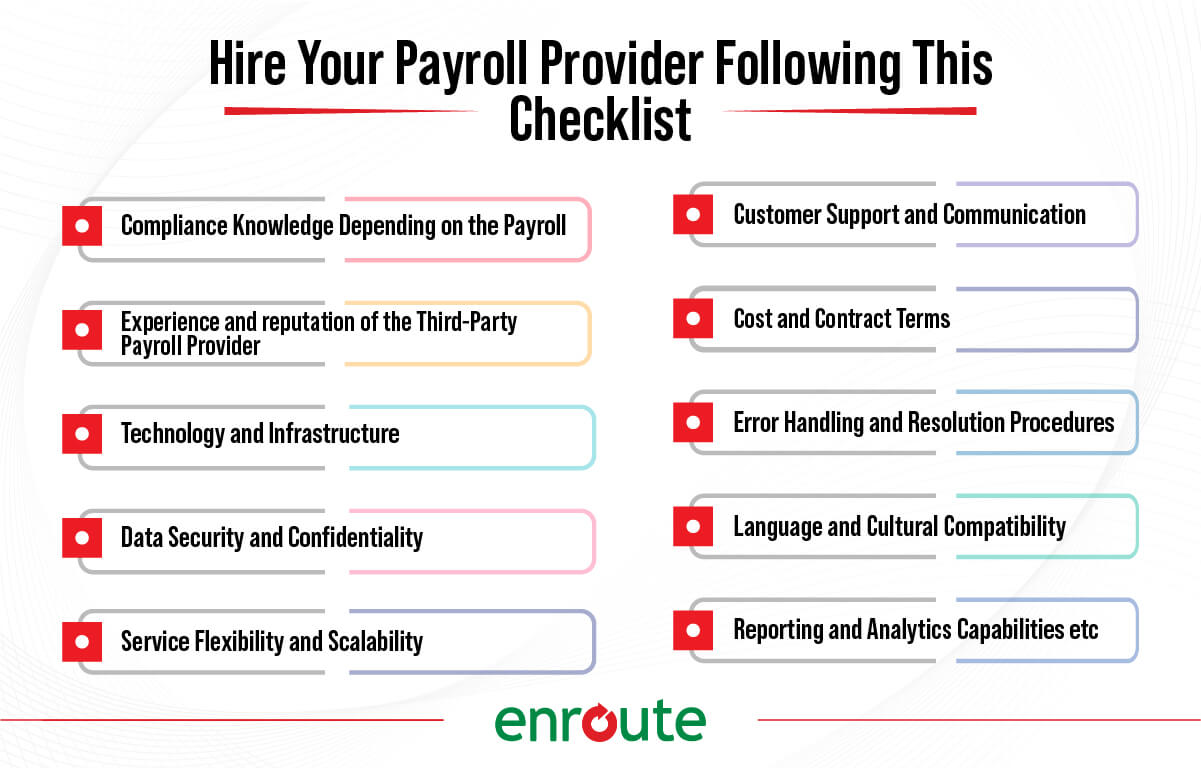

Assuming that so far we have been able to clarify the message of advantages of outsourcing payroll. A large number of firms in the UK, USA & European markets outsource their payroll to a third-party provider to unburden their HR team and focus on their core functions. But to get the proper advantages of outsourcing payroll services you need to look out for a checklist. Here a checklist for your reference.

- Compliance Knowledge Depending on the Payroll.

- Experience and reputation of the Third-Party Payroll Provider,

- Technology and Infrastructure.

- Data Security and Confidentiality.

- Service Flexibility and Scalability

- Customer Support and Communication

- Cost and Contract Terms

- Error Handling and Resolution Procedures

- Language and Cultural Compatibility

- Reporting and Analytics Capabilities etc.

Conclusion

Outsourcing payroll to a professional payroll management provider is a strategic move and it should be considered thoroughly while considering whether to outsource your company’s payroll and navigate your organization through this disruptive time or if you want to build an in-house team to tackle the complexities.

We believe with the considerations outlined in this blog, we have made it clear from a company’s perspective how can they make an informed choice, ensuring they partner with a provider that meets their specific needs in terms of compliance, technology, security, and scalability.

If you are thinking of considering your options and outsourcing payroll to an experienced payroll provider in Bangladesh Enroute International Limited is a reputed one.

Enroute’s services in payroll allow you to make the best decisions for your organization while expanding your business scale. If you have diverse needs we can also provide you with payroll consultancy so you can choose the right payroll service for your current & future needs. But if you have made up your mind to hire a payroll, we are here for you. For more BPO functions read here about the top rapidly growing BPO companies in Bangladesh.

Frequently Asked Question for Benefits of Payroll Outsourcing

- What are the benefits of outsourced payroll?

There are numerous benefits of outsourced payroll. Some of them are:

- Cost Savings: Reduces overhead expenses associated with in-house payroll management.

- Regulatory Compliance: Ensures adherence to local and international payroll laws and regulations.

- Time Efficiency: Frees up internal resources to focus on core business activities.

- Access to Expertise: Leverages the knowledge and experience of payroll specialists.

- Advanced Technology: Utilizes state-of-the-art payroll software and systems.

- Scalability: Easily adjusts to changes in business size and payroll needs.

- Data Security: Provides robust protection for sensitive payroll and employee data.

- What are the pros and cons of outsourcing payroll?

Here are the pros & cons of outsourcing payroll.

Pros:

- More cost effective

- Expertise with compliance

- Time saving

- Technological advantage

- Reduced error

- Data Security etc.

Cons:

- Less direct control

- Dependency over provider

- Integration issues

- Communication barrier

- What does outsourcing payroll do?

Outsourcing payroll providers has a definitive task from month to month. These can include:

- Calculating paychecks

- Managing taxes & deductions

- Maintaining compliance with laws

- Filling tax documents

- Handling payroll queries

- Reporting &

- Month to month update

- What are the risks of outsourced payroll?

Considering the benefits of outsourced payroll, the upside is really high. But as like other business outsourced payroll has some risks as well. some of the certain risks behind outsourced payroll are,

- Data security concern

- Compliance risk

- Quality of service

- Hidden costs

- Communication barriers

- Limited customization

- Cultural misalignment

- Legal obligations etc.

- What to consider when outsourcing payroll?

When you are considering to outsource your payroll and looking for a service provider. Here are some of the facts you need to go through:

- Compliance Knowledge Depending on the Payroll.

- Experience and reputation of the Third-Party Payroll Provider,

- Technology and Infrastructure.

- Data Security and Confidentiality.

- Service Flexibility and Scalability

- Customer Support and Communication

- Cost and Contract Terms

- Error Handling and Resolution Procedures

- Language and Cultural Compatibility

- Reporting and Analytics Capabilities etc.

- What is BPO payroll?

BPO payroll, or Business Process Outsourcing for payroll, refers to the practice of contracting a third-party payroll service provider to manage all aspects of a company’s payroll functions.

This outsourcing model involves transferring the responsibility of managing payroll operations from calculating pay and managing taxes to ensuring compliance with legal requirements to an external organization specialized in these tasks.

7. How Much Does Outsourcing Payroll Cost?

The cost of outsourcing can vary from country to country & types of services you are looking for. Typically, in APAC region the cost of outsourcing is lower than other continents in the world. Bangladesh is an emerging player in the global payroll game providing one of the best lucrative outsourcing options globally.

Leave a Reply