Payroll processing might sound like a complex topic, if you are not related to it yet. Basically, payroll processing is a simple term in business or organizational operation. & if you are familiar with it, you don’t need to feel intimidated, as we are taking a deeper look into payroll processing for business in this article.

What is Payroll Processing?

In basic terms, payroll processing is the operation of managing the payments that cover everything from registering an employee to the payroll software to giving them their paycheck according to their pay scale.

In basic terms, payroll processing is the operation of managing the payments that cover everything from registering an employee to the payroll software to giving them their paycheck according to their pay scale.

For a small business, normally it is the owner that handles all of it. But as the business starts to grow over time, the number of employees gets bigger.

As a result, it becomes a very time consuming task for an owner to manage it all.

Sometimes business owners also hire accountants or HR managers. Some of them also outsource payroll service.

In the modern context, a considerable option for payroll management is also payroll accounting software. For the organizations to ensure payroll compliance with state and national laws, there are a lot of taxes to keep tabs on while processing payrolls. Payroll consultants help the business owners from that aspect to process the payroll according to such challenges.Let us show you in 8 simple steps how the payroll process works.

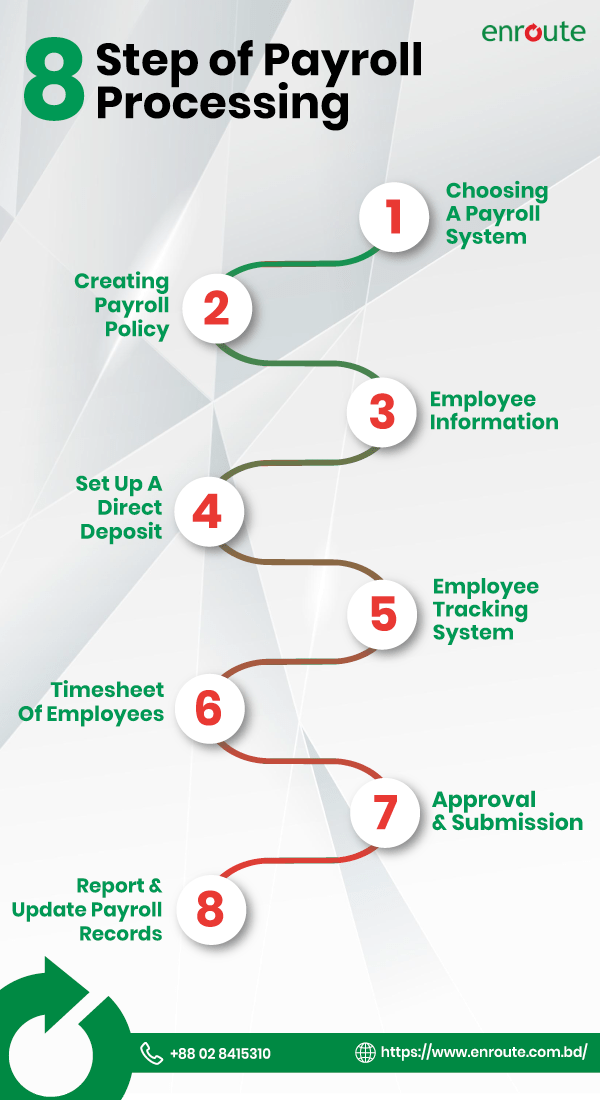

Choosing A Payroll System:

Managing the payroll does not always cover paying for the employees. Payroll management also covers managing the payroll according to the latest labor laws and vat laws. Payroll management services include a wide range of subjects in terms of employee tracking to recordkeeping. While establishing the process of payroll all of these are to be considered as an important part of the operation.

Considering it all, there are basically 3 ways to process the payroll.

- Manual Payroll,

- Outsourced Payroll

- Payroll Software

Manual Payroll:

Manual payroll is the traditional way of managing the payroll process. Usually, manual payroll records are kept on paper or spreadsheets. Although it is a traditional method manual payroll has been effective for many years in the past. But to face the complex challenges of the future and secure data for the future this process might come up with challenges of its own.

Outsourced Payroll:

With the moving time, the payroll process has seen its fair share of challenges as well. As the dynamics of the challenges are changing over time, company’s rely on outsourced professional payroll services for greater efficiency with a professional approach. This concept is being popularized worldwide. In this approach, outsourcing firms roofs all the aspects of the payroll process with greater efficiencies handled by professionals. Which often can bring the companies with a cheaper option.

Payroll Software:

Payroll management by software varies according to need & features. It also covers a wide range of facilities to make payroll and HR management easier. To complete the tasks of record-keeping and employee tracking, payroll software is an easy and convenient option. In the market of global pay solution, payroll software has taken its fair share of management too. It is a popular concept too as technologies are advancing with passing time newer features are being included to solve advanced payroll processing problems.

Before committing to any of these options, business owners need to analyze according to their business need, growth benefits & complexity to take an effective option. As manual payroll processing is quite an old way, considering the future and possible scenarios for greater payroll management you might consider the payroll software & outsourced payroll service altogether.

Creating Payroll Policy:

Before creating a payroll policy by which you will conduct your operational process, you need to create a payroll policy according to your local or national labor law. In most cases, some loopholes can be left out without having the proper awareness about the latest laws which can trigger many alarms at various times.

So to make a concrete policy latest laws needs to be included in the policy. When you take the decision to outsource payroll services the firms can create a policy accordingly. But some of the things you can have a look at when creating a payroll policy are,

- Pay dates & length of each payment period to the employees, and when your employees will get paid after that.

- How you want to pay your employees, which includes the options of cash, deposit, end to end transaction.

- Payroll deduction according to employee records or benefits which can impact an employee’s paycheck.

Employee Information:

Forsecure payroll services, the first task of any proper payroll process management is gathering all the necessary information of the employee. In the context of different countries, this documentation can vary. Anything related to the national identity of the employee is the first point of data for this. To verify the background if the employee is not subject to any crime on investigation it is important for the safety of the company.

An employee also has to pay his taxes in time if he is eligible for it. For the income tax consultancy and any services related to it, registration information is required. Then if the employee is subject to company benefits and insurance the nominee information is also required. Depending on various kinds of benefits company’s can demand all the documents necessary from the employee.

Set Up A Direct Deposit:

Direct deposit is an important part of efficient payroll management. It refers to the term of employers paying directly to the employees directly through the bank. Direct deposit is not a free commodity but it’s convenient for both employers and employees. Business owners can set up direct deposits using a business bank directly to their employee’s accounts.

Usually, employers need the information of an employee’s bank account to conduct this operation. In this case, the employees need to submit the account number they want to receive the payment on to the payroll management individual or agency.

Every month at that specific time when the company pays to its employees the money gets deposited automatically after the company approves it and sends the software-generated report according to the employee’s record or if any addition or deduction needs to be made. So, this is an effective solution. Once the employee is registered to that system of direct deposit, this is an efficient solution.

Employee Tracking System:

Setting up the employee tracking system is an important part of the payroll process. According to the latest labor laws, if the company wants to keep a transparent system of the payroll process, this needs to be implemented and executed properly. For the best hr people management automation of employee tracking is a must for now & the future. Employee tracking can be implemented by many options.

Some traditional method of tracking was registering attendance & absenteeism manually. Nowadays, with the advancement of the system, a central CRM can register the data with the entry and exit timing. Also for the best payment management, this system automation is important.

With automated software-generated reports, exclusive hourly-rated payments get easier. Also, the absenteeism deduction gets easier to calculate if needed. So for the best practice of payroll processing employee tracking is needed to implement rightly.

Timesheet Of Employees:

After completing all these steps successfully, it’s time for the payroll. All you need to do is now observe the timesheet & structure the payment accordingly. If the record is being kept in a manual record book, then it will take a huge time to add all the data together for final output. Best payroll companies keep it in a software-based format for maximum efficiency and easier execution. At the end of each month gathering, all the timesheets of all the employees become a huge calculative burden if you don’t keep it in an automated format. So if you are outsourcing your payroll to other company’s use a software-based tracking and timesheet for all the employees. So this is also a very important part of the payroll process.

Approval & Submission:

After you have gathered all the data, timesheet, and records needed to issue the final paycheck, all you need to do is approve the respective paycheck & submit it for execution. Now if you are using a direct deposit method that runs through the bank, you can submit it in time & employees will receive their paycheck just in time.

For easier hr pay solution it is an effective solution to keep it all automated so when you approve and submit the paycheck request the payment gets done at a quick time. Which shortens the employee waiting period and improves their satisfaction rate.

Report & Update Payroll Records:

Finally, when you are done paying the employees, the last and final part of the effective payroll process is reporting and keeping records. For the best-managed funds and auditing company’s must keep their payroll record updated. Even if it is a manual payroll or outsourced payroll, record-keeping is the biggest part of a company’s sustainability. With proper record keeping, a company can analyze and take decisions accordingly. When you run this cycle over & over again, you’ll have a successful payroll process in your hand. Which can be optimized according to the need of the organization.

How Long It Can Take?

Payroll processing can take several hours to several days, depending on the efficiency of the operation and the experience that is leading it. So, the more efficient it is, the shorter time it needs. And if the operation is manual, it takes longer. For the best managed payroll services, it is important to automate them in many stages. From record-keeping to crosschecking this helps tremendously in business operations.

Automated tools reduce time greatly. Also, When it comes to calculating taxes for each individual, without using such technological options it might take a very long time which can also have errors. Once you approve and submit the paycheck, depending on the classification of the check, and how the employee wants to receive it, it can depend from 24 to 72 hours in most cases.All in all, payroll processing can be done in efficient manner once you automate it in certain areas. Which will provide you with an operational advantage for your respective company. Also it will become easier for HR and Payroll individuals to run the operation in efficient manner.

Leave a Reply